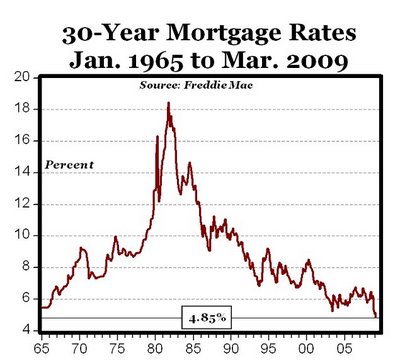

A chart from Carpe Diem:

The 30-year fixed mortgage rates are the lowest ever recorded. It’s a great time to refinance or buy a home.

This blog is for discussing issues in our complex global economy.

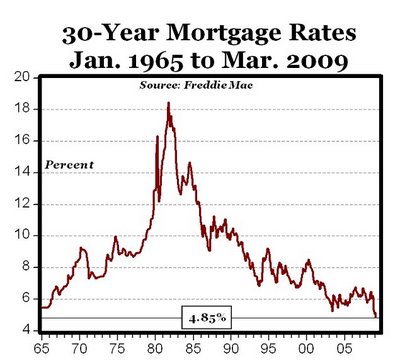

A chart from Carpe Diem:

The 30-year fixed mortgage rates are the lowest ever recorded. It’s a great time to refinance or buy a home.

California existing-home sales slid 0.8% in February, but jumped 83% compared to the same period a year ago as homebuyers continued to flock to sharply reduced prices and interest rates in the nation’s largest housing market.

The sales of 620,410 single-family homes on a seasonally adjusted, annualized basis came as the median price of a home plunged 40.8% to $247,590 from a year ago, according to estimates released Wednesday by the California Association of Realtors. The increased sales activity from a year earlier helped shrink the inventory of unsold homes to 6.5 months in February from 15.3 months in the 2008 period, the Realtors group reported.

California’s resurgence comes as housing markets nationally are showing signs of new life, as well. Existing-home sales nationwide jumped a seasonally adjusted 5.1% in February, the biggest one-month gain since late 2003, the National Association of Realtors reported on Monday. The group said buying activity was strongest in places such as Southern California and Las Vegas, which have a glut of foreclosures.

Few experts say California is out of the woods, though. With an unemployment rate of 10.5% in February that is expected to continue to rise, they say many more foreclosed properties are likely to end up on the market, weighting down housing prices.

A great explanation from David Colander as to “why” an economics major is one of the best choices. Economics is the most popular major at Harvard.

Bad news for those who attend a Community College first. They don’t know why yet, I look forward to those results:

EARNINGS BY DEGREE

Average annual earnings by education:

| Final degree earned | No asso-ciate degree | With asso-ciate degree |

| Bachelor’s | $54,667 | $52,022 |

| Master’s | 61,323 | 56,997 |

| Doctorate | 71,246 | 62,906 |

| Professional | 79,491 | 70,349 |

Source: The Federal Bank of St. Louis, based on data from the 2003 National Survey of College Graduates

Dan Walters points out what a great deal California’s college system is:

The $20-per-unit community college fee is, by far, the lowest in the nation. The $600 it costs for a year’s full load of classes in California would be more than $900 in the next-lowest state, New Mexico, and is less than one-fourth the national average of $2,700.

State university fees, $3,849 a year, are much lower than any of the other comparable state university systems and scarcely half the average of $7,516.

The University of California’s current fees, $8,027 a year, are not quite the lowest of comparable systems – University at Buffalo, N.Y., has that ranking at $6,285. But UC’s fees are nearly $2,000 below the average and just two-thirds of the most expensive school, the University of Illinois.

Lost in all the big business (AIG, autos, and banks) press is one very important announcement:

Obama announces plan to aid small businesses.

Why is this important, because small businesses account for 70% of U.S. jobs.

From The Mess That Greenspan Made:

The Commerce Department reported a big upward revision to retail sales in January and a modest decline of just 0.1 percent in February as tumbling automobile sales were offset by higher spending at gasoline stations and clothing stores.

With California’s unemployment rate over 10%, how can Californians afford tuition which is still rising MUCH faster than inflation? We will probably see what is happening in New York, UC students will choose the State University system to save money. Private colleges, such as St. Mary’s College of California, have an opportunity to gain (St. Mary’s of CA is only raising their tuition by 2%). The last will be more students attending California’s Community Colleges for two years to save money.

Facing a significant budget shortfall, the University of California plans to increase tuition at its 10 campuses by nearly 10 percent by July, in time for the summer session.

From Megan McArdle:

Apparently Congress’ “buy American” clause in the bailout funds is having its desired effect: Bank of America has rescinded its job offers to foreign MBAs. I suspect that Bank of America is at least as motivated by a need to reduce headcount as it is by fear of Congress. But cutting your recruitment based on country of origin, rather than skills and fit, does not seem like the most efficient way to do it.

As a committed free trader–and an MBA who went through the mass layoffs of the last recession–my sympathy is all with the MBAs. These are people who mostly aren’t eligible for scholarships or subsidized student loans; they’ve borrowed or spent close to $100,000 in America to get their degree, many of them in hopes of staying here. They’re intelligent, highly skilled, and promise to be net contributors to the tax system . . . so America kicks them in the teeth and sends them home without a job.

This means B of A will lose some of the best MBA graduates. It will only hurt them in the long-run. This could also have a negative impact on U.S. MBA programs if foreigners stop applying.

The unemployment rate rose to 8.1% from 7.6% in January. It was the highest reading since December 1983 and higher than economists’ projections of 7.9%.

The government reported Friday that employers cut 651,000 jobs in February, down from a revised loss of 655,000 jobs in January.