Some normative statements from the WSJ:

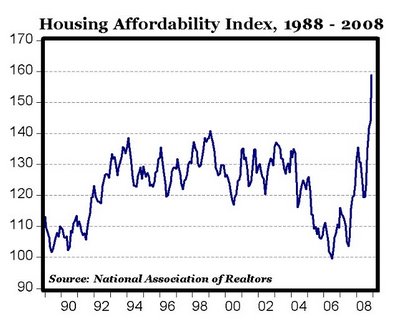

–Not only are housing prices stabilizing, they are starting to grow. The three most widely used yardsticks for measuring housing prices (The National Association of Realtor’s median price, the Federal Housing Finance Agency (FHFA) price indexes and the Case-Shiller prices indexes) are telling a similar story…First, it will help banks holding toxic assets: With house prices stabilizing, these assets will regain some of their lost value. Second, the market for selling homes will get a short-term shot in the arm from the so-called “fence-sitters” who have been waiting for prices to fall even more before buying a home. Third, rising prices will help consumer spending through the wealth effect. –Patrick Newport, economist at IHS Global Insight

–The breadth of gains across cities was impressive, with eighteen out of twenty cities recording increases, some of them very strong. Cleveland rose 4.2% after rising 4.1% last month, so its yearly rate is now down only 3%. …Some have argued that the recent improvement is simply a seasonal effect. That is playing some role, but seasonally adjusted, prices were flat in May and up 0.8% in June, suggesting that some underlying improvement is occurring…. Overall, this appears like a genuine turn. –Ian Morris, HSBC’s head of U.S. economics

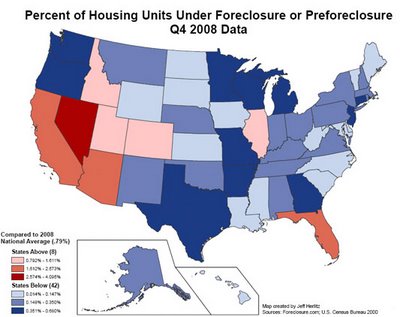

– Will the bottom hold?The main concern here is that various foreclosure moratoria temporarily limited the downward pressure from distressed properties and as foreclosures pick up again, prices will head lower. This is certainly possible, but it feels like the firming in demand for homes will be sufficient to counteract the downward influence from the ongoing foreclosure wave…While it would be nice (not least as a homeowner myself) to think that home prices are going to quickly recover a chunk of the ground lost over the past 2 or 3 years, we are simply not that optimistic. –Stephen Stanley, RBS Securities